Managing customer credit isn’t just about collecting payments, it’s about balancing growth with financial security. Businesses that extend credit without the right controls risk late payments, strained cash flow, and unnecessary losses. That’s why effective credit management is more than an accounting function; it’s a strategic tool that strengthens customer relationships while keeping your business financially resilient.

So, what is credit management, and why is it so important in today’s fast-paced business environment? Let’s break it down.

What Is Credit Management?

At its core, credit management is the strategic process of granting credit to customers, monitoring their payment behaviors, and ensuring timely collection of outstanding invoices. It ensures that while sales grow, risk doesn’t grow with them.

How credit management works is straightforward, it assesses a customer’s creditworthiness before offering credit, assign appropriate credit limits, and follow up with structured payment collection processes. It’s a balance between fueling sales and protecting the business from cash flow interruptions and bad debt.

Types Of Credit Management

There’s no one-size-fits-all method. Companies typically implement a combination of the following:

- Credit Policy Management: Defines the rules, approval workflows, and customer credit terms.

- Customer Credit Evaluation: Involves reviewing financial history and business behavior.

- Credit Limit Assignment: Determines how much credit can be safely extended.

- Monitoring and Collection: Keeps track of receivables and initiates follow-ups when needed.

- Credit Insurance and Risk Mitigation: Adds an extra layer of protection in volatile markets.

Each of these practices helps reduce exposure to credit risk and maintain healthy business operations.

Importance Of Credit Management

Credit management is more than a protective measure, it’s a business enabler. Here’s why it matters:

1. Prevents Bad Debt

An effective credit system helps you assess customer risk before offering credit. This reduces exposure to non-paying clients and protects your bottom line.

2. Improves Cash Flow

Timely collections keep cash circulating within your business. Healthy receivables ensure you always have working capital when you need it.

3. Builds Stronger Relationships

Clear credit terms and consistent communication enhance professionalism. Clients trust businesses that manage accounts transparently and fairly.

4. Enables Smarter Decisions

Access to real-time credit data means you can make informed decisions about extending credit, budgeting, and allocating resources more efficiently.

5. Drives Business Growth

When credit management is done right, it doesn’t just prevent problems, it unlocks growth by making revenue more predictable and controllable.

Key Benefits Of Credit Management

Companies that prioritize credit management often enjoy:

- Lower Days Sales Outstanding (DSO): Faster payments, better cash cycles.

- Increased Profit Margins: With fewer write-offs and less reliance on financing.

- Smarter Customer Segmentation: Tailor terms based on historical performance.

- Complete Credit Visibility: See exactly where and why delays happen.

These benefits of credit management directly impact a company’s financial strength and scalability.

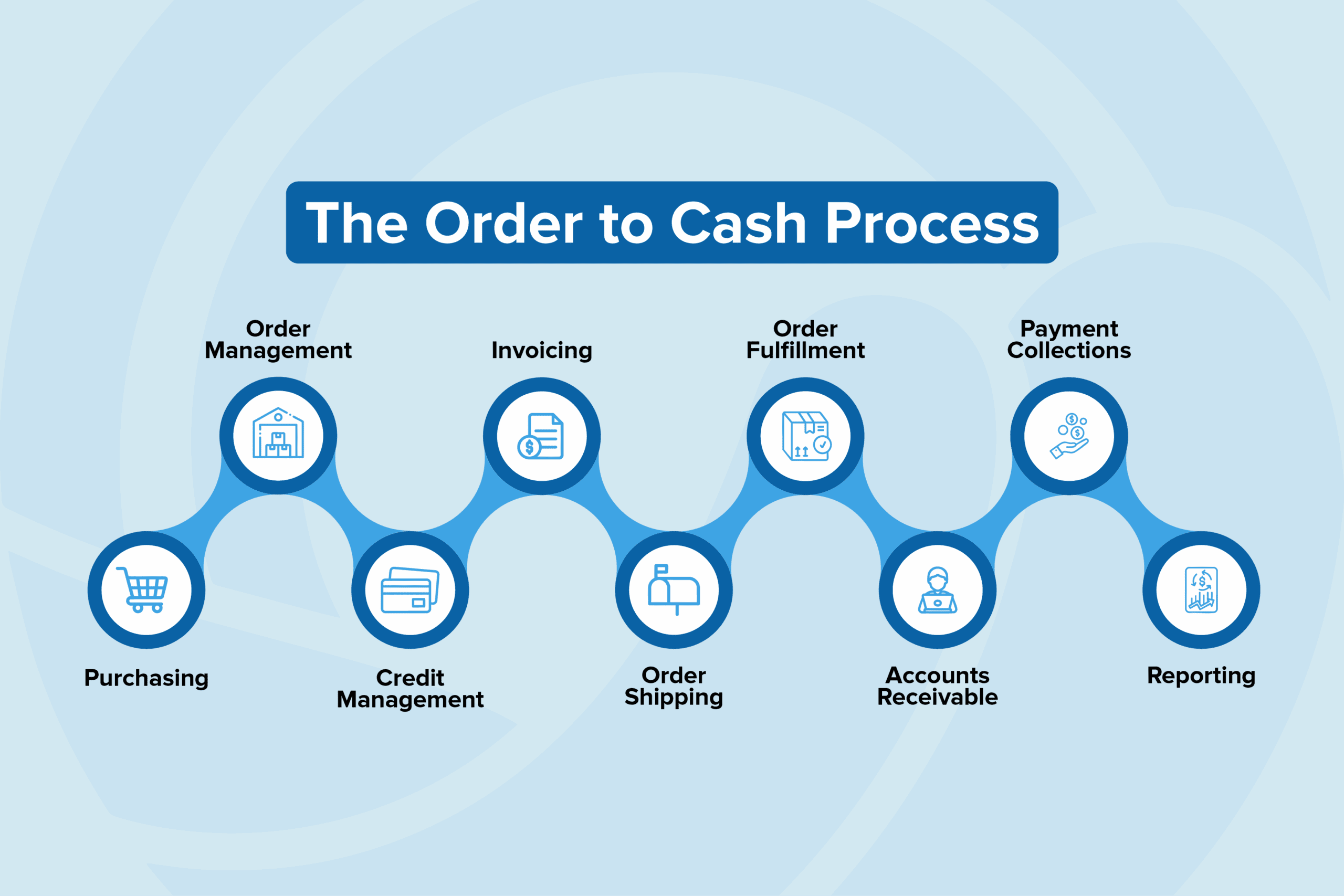

The Credit Management Process

A robust credit management process follows a logical flow:

Step 1: Establishing Credit Policies

Lay down clear rules about who gets credit, under what terms, and with what limits.

Step 2: Customer Credit Assessment

Use data to assess financial health, payment history, and risk levels before onboarding.

Step 3: Credit Limit Setting

Assign realistic limits that balance opportunity with caution.

Step 4: Order Approval & Credit Check

Ensure that orders don’t exceed set limits using automated systems.

Step 5: Invoicing & Receivables Tracking

Send invoices promptly and track them until payment is received.

Step 6: Collections & Follow-ups

Escalate delays professionally, maintaining customer relationships.

Step 7: Review & Optimization

Continuously improve the process by analyzing patterns and feedback.

Each step safeguards your working capital while supporting revenue growth.

Challenges In Credit Management

Of course, managing credit isn’t always smooth sailing. Common hurdles include:

- Lack of Visibility: Data is often scattered across systems.

- Manual Processes: Increases errors and slows down approvals.

- Poor Collaboration: Sales and finance teams often work in silos.

- Late Collections: Missed follow-ups can lead to long-term loss.

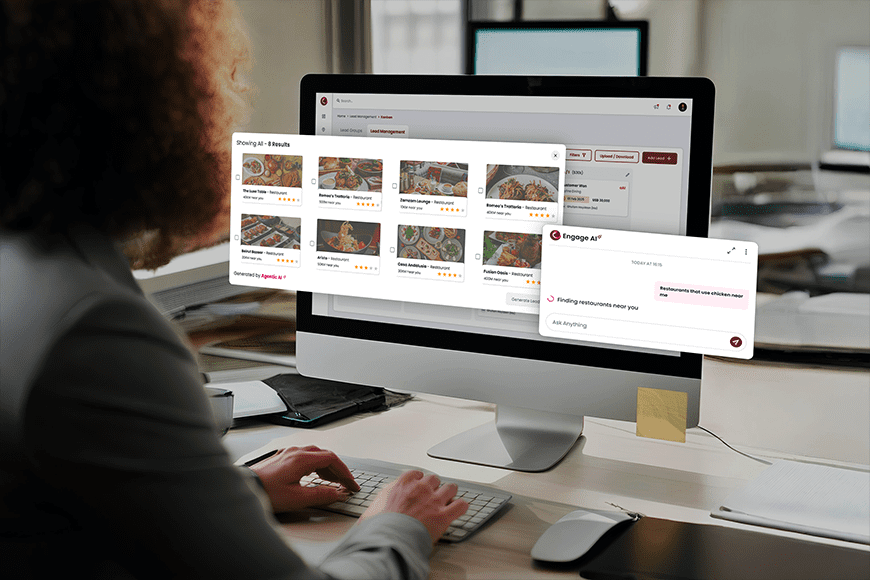

That’s why more businesses are adopting integrated digital platforms to streamline their credit workflows.

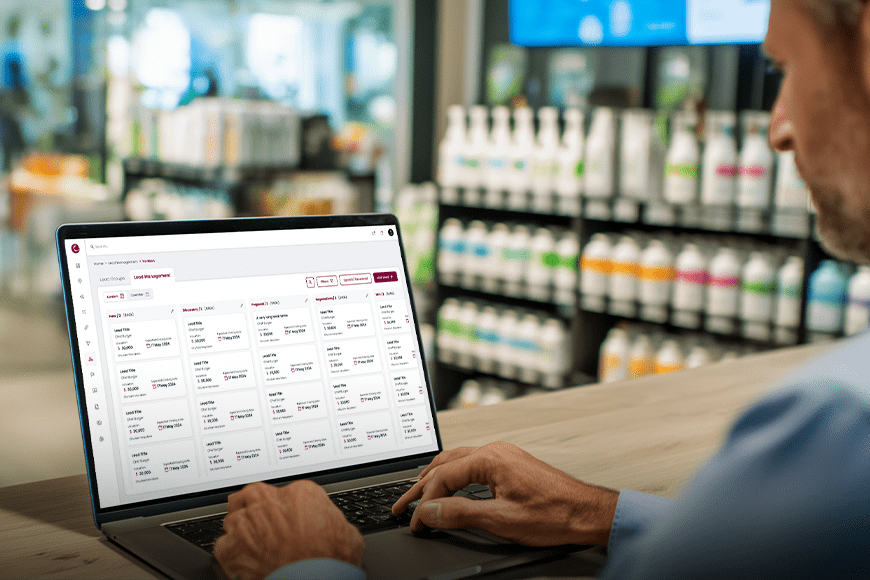

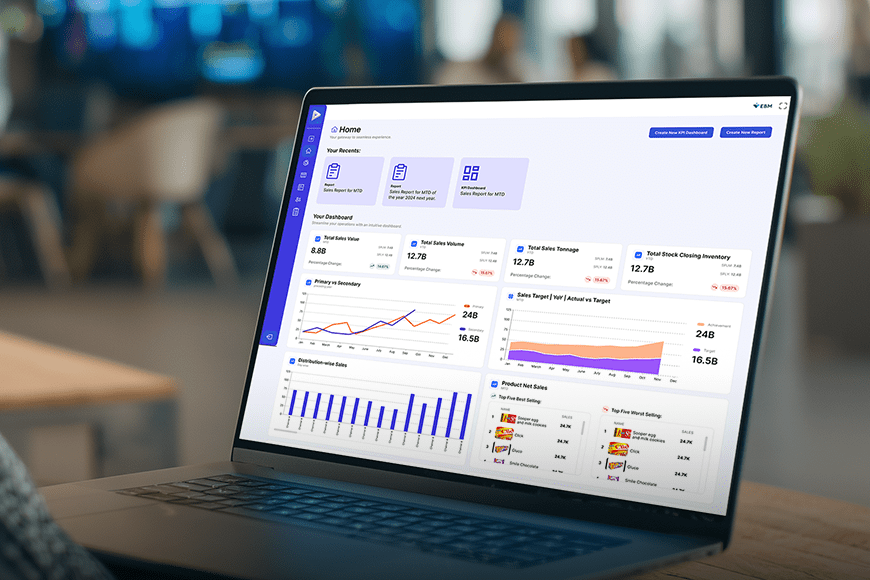

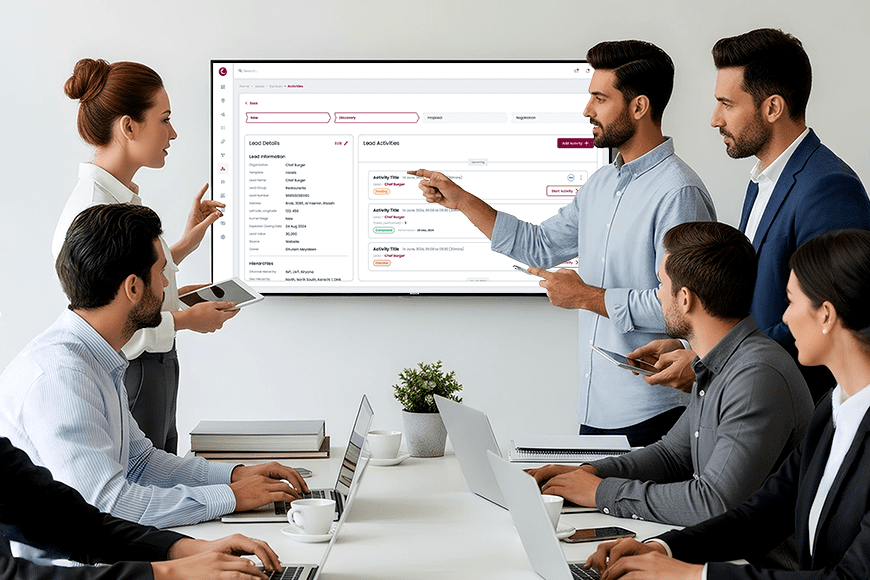

How Salesflo Core Simplifies Credit Management

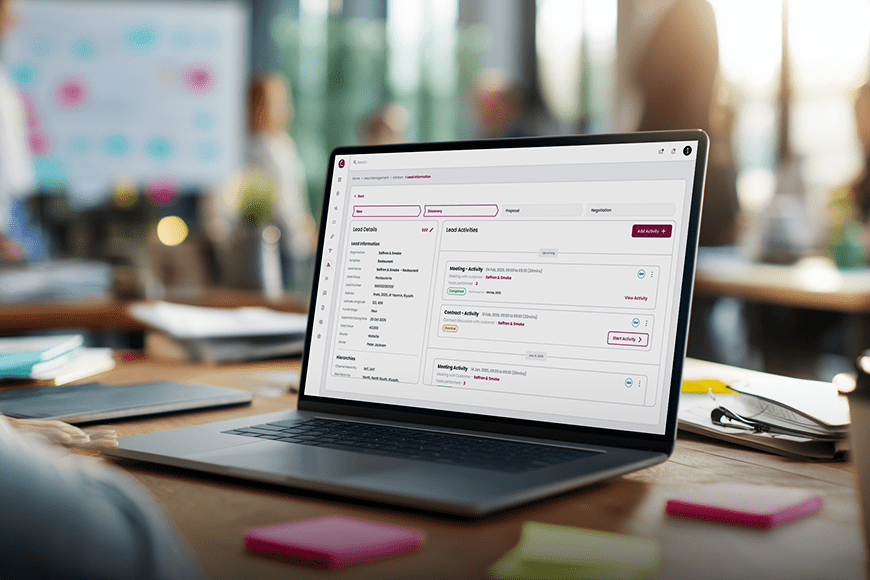

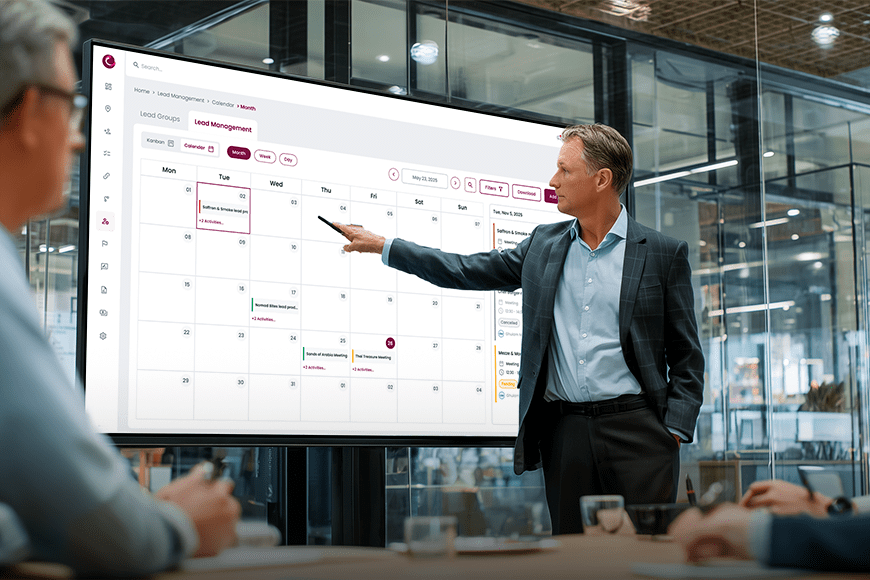

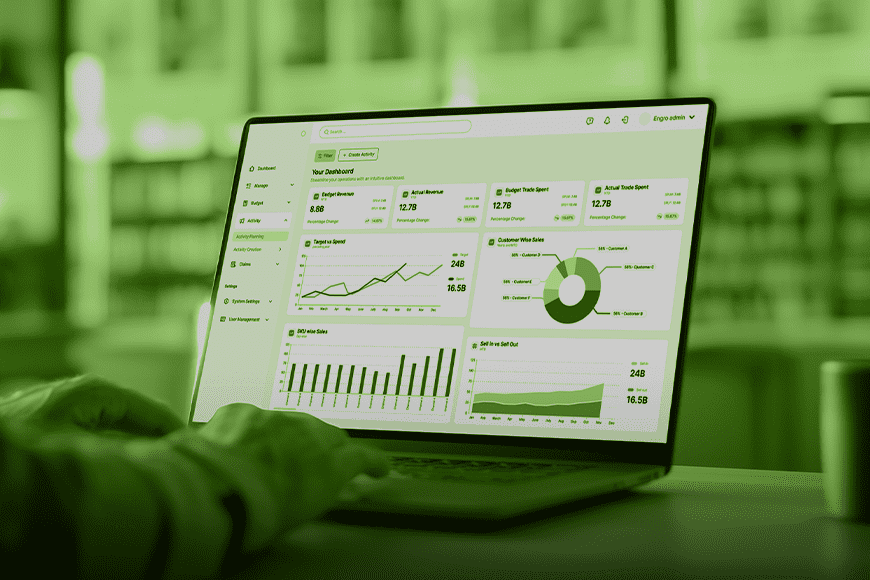

Salesflo Core is designed for businesses that want better control over credit and collections without added complexity.

Here’s how it supports modern credit management:

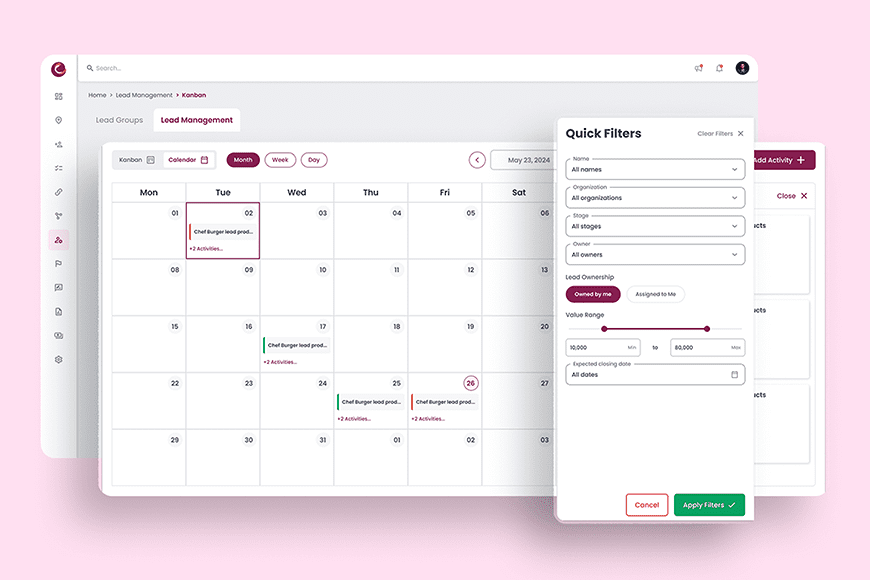

- Credit Limit Configuration

Assign credit limits by customer or distributor, aligned with real-time data. - Receivables Tracking

Stay ahead of overdue invoices with automated alerts and reports. - Order Blocking Based on Limits

No more manual checks, Salesflo blocks orders that exceed credit limits. - Integrated Financial Modules

Access end-to-end visibility across sales, claims, payments, and profitability. - Automation Across Order-to-Cash

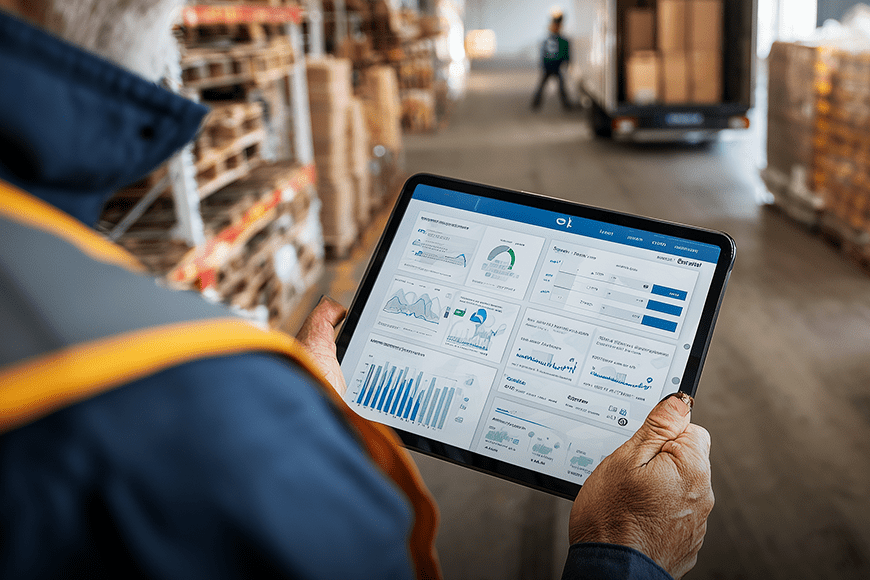

Remove friction from booking to billing with smart, connected workflows. - Real-Time Insights

Track trends, forecast payments, and make proactive decisions from one dashboard.

With Salesflo Core, businesses don’t just manage credit they optimize it for growth, efficiency, and stability.

Conclusion

In today’s competitive and fast-paced environment, credit management isn’t optional, it’s essential. Businesses that invest in strong credit strategies not only reduce risk but unlock greater profitability and trust.

Tools like Salesflo Core are redefining what’s possible in this space bringing automation, visibility, and control to a traditionally manual process.