In today’s competitive business environment, moving from customer order to final payment isn’t just a transaction, it’s the engine that keeps revenue flowing. This end-to-end workflow, known as the Order to Cash (O2C) process, covers every critical step from order placement and inventory validation to delivery, invoicing, and payment collection. When managed effectively, O2C doesn’t just ensure smooth operations, it drives customer satisfaction, cash flow stability, and long-term growth.

But what is Order to Cash exactly, and why is it so important to manage it effectively?

What is Order to Cash?

The Order to Cash business process refers to the entire workflow a company follows to receive and fulfill customer orders, from initial purchase all the way to receiving payment. It includes everything from order entry, inventory checks, and invoicing to delivery, payment processing, and reporting.

Simply put, it’s the engine that drives your revenue and when managed well, it helps reduce errors, speed up collections, and create a better experience for your customers.

Why Does the O2C Process Matter?

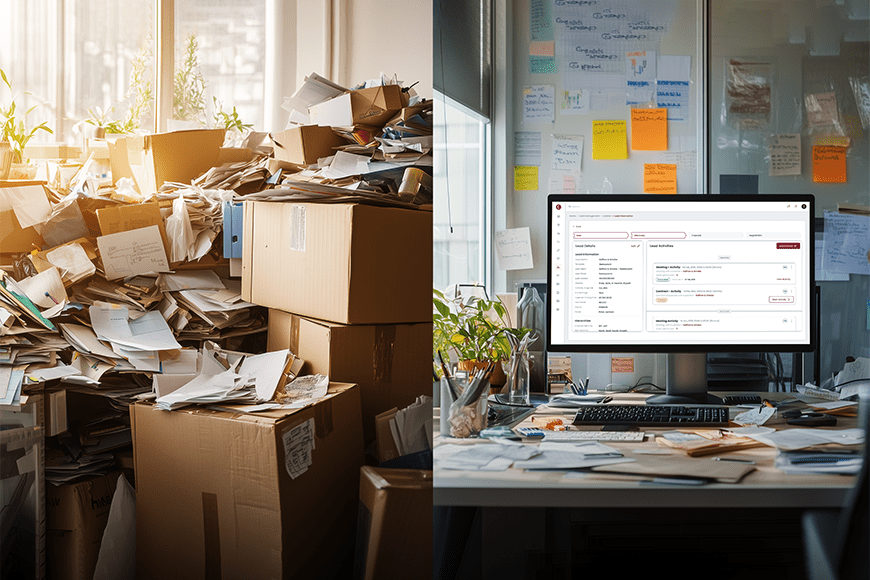

When your O2C process is optimized, your entire business runs smoother. You get paid faster, your teams stay aligned, and your customers are more satisfied. But when it’s broken or inefficient? You risk delays, revenue leakage, and unhappy clients.

That’s why modern companies are increasingly investing in Order to Cash optimization to automate and improve this cycle.

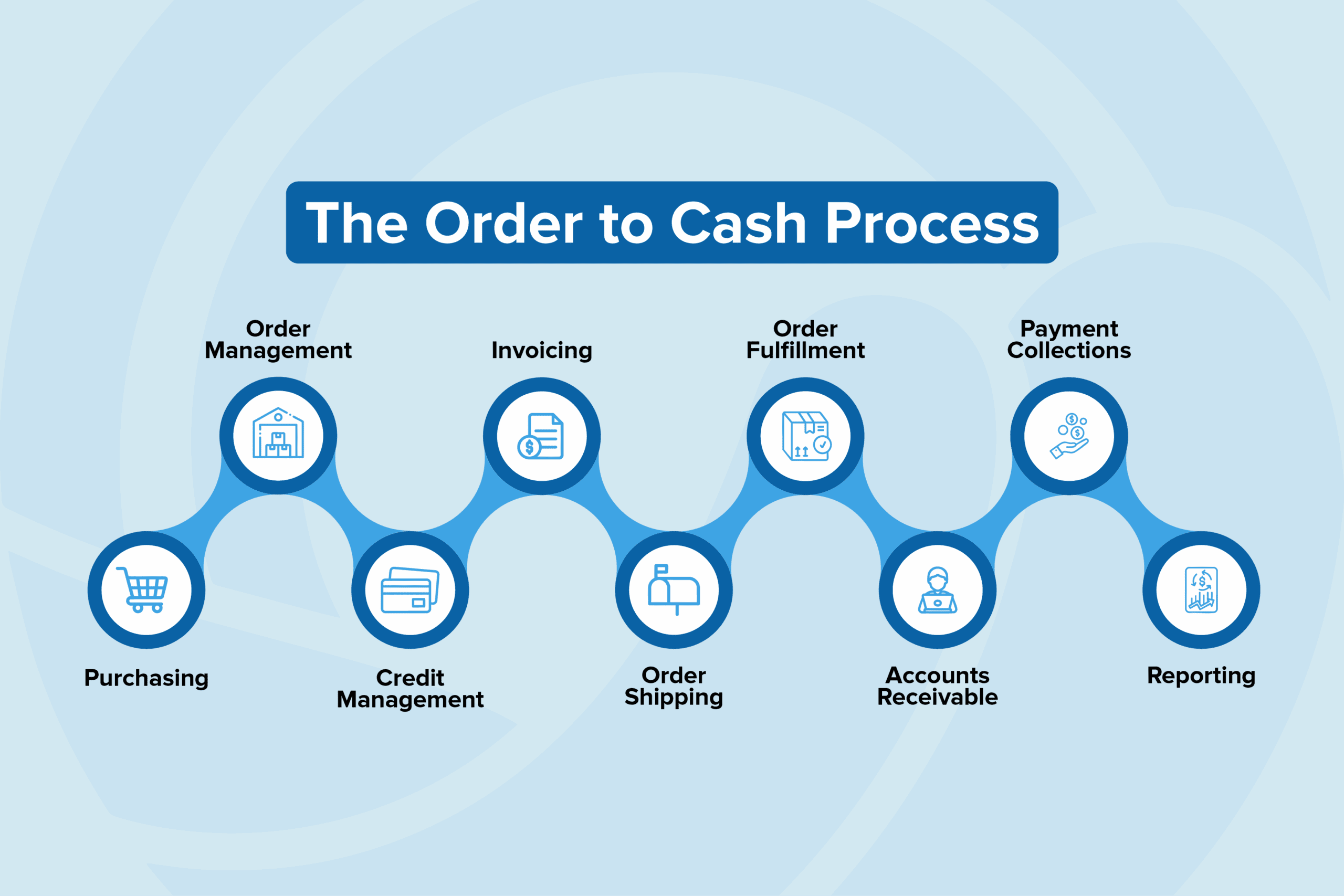

Steps in the Order to Cash Process

Let’s walk through the steps in the Order to Cash process, explained clearly so you can see how each one connects.

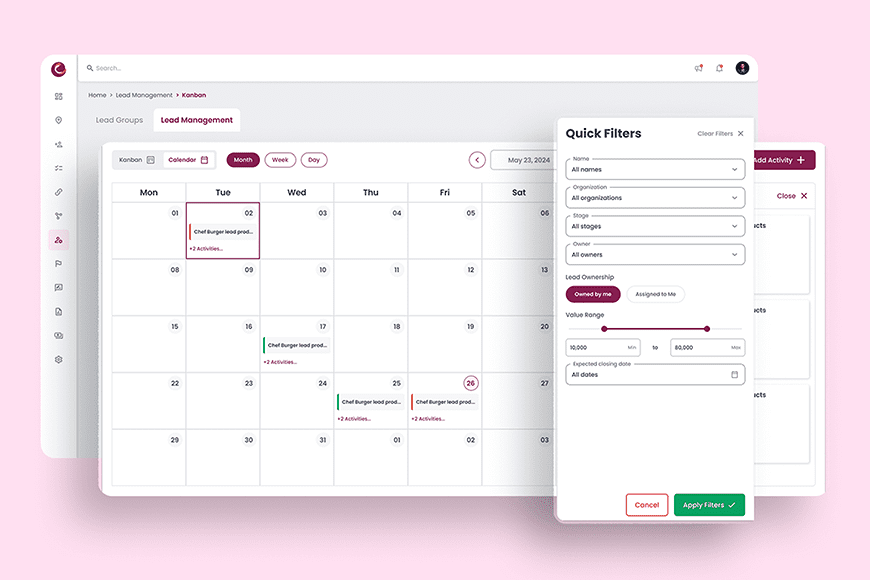

1. Order Management

The journey starts when a customer places an order. This step involves verifying the details, checking stock availability, and logging the order into your system. It’s crucial for the process to be accurate and fast, any error here affects everything downstream.

2. Credit Approval

Before fulfilling the order, businesses typically assess the customer’s creditworthiness. This reduces financial risk and helps ensure smooth collections later. Many companies automate this with predefined credit limits and customer history checks.

3. Order Fulfillment

Once the order is approved, it’s time to pick, pack, and ship. Efficient order fulfillment ensures the customer gets the right product at the right time. Delays or inventory mismatches here can lead to major disruptions.

4. Shipping and Delivery

The physical movement of goods is coordinated at this stage. Tracking, confirmations, and proof of delivery are vital to ensure transparency and customer satisfaction.

5. Invoicing

As soon as the goods are shipped (or sometimes earlier, depending on the agreement), an invoice is generated and sent to the customer. Automation here minimizes manual entry and reduces billing errors.

6. Accounts Receivable Management

This is where the business monitors outstanding payments. Keeping track of aging invoices, following up on overdue accounts, and sending reminders falls under this step. It’s a vital checkpoint for managing cash flow and reducing Days Sales Outstanding (DSO).

7. Payment Collection

This is where the cash finally comes in. Whether it’s via bank transfer, card, or cheque, efficient payment processing is key. Businesses are now leaning heavily into Order to Cash automation to speed up this stage and reduce outstanding receivables.

8. Reporting and Analytics

Once the transaction is complete, businesses analyze the cycle for performance metrics, exceptions, and improvement opportunities. This is where Order to Cash analytics help you gain real-time visibility into cash flow and process efficiency.

Benefits of Order to Cash Process

A well-managed Order to Cash process doesn’t just benefit finance, it impacts your entire business. Here’s how:

- Shortens payment cycles and improves cash flow

- Enhances customer satisfaction through timely delivery and accurate invoicing

- Reduces manual errors and improves team efficiency

- Provides visibility into outstanding payments and inventory

- Supports better decision-making through Order to Cash analytics

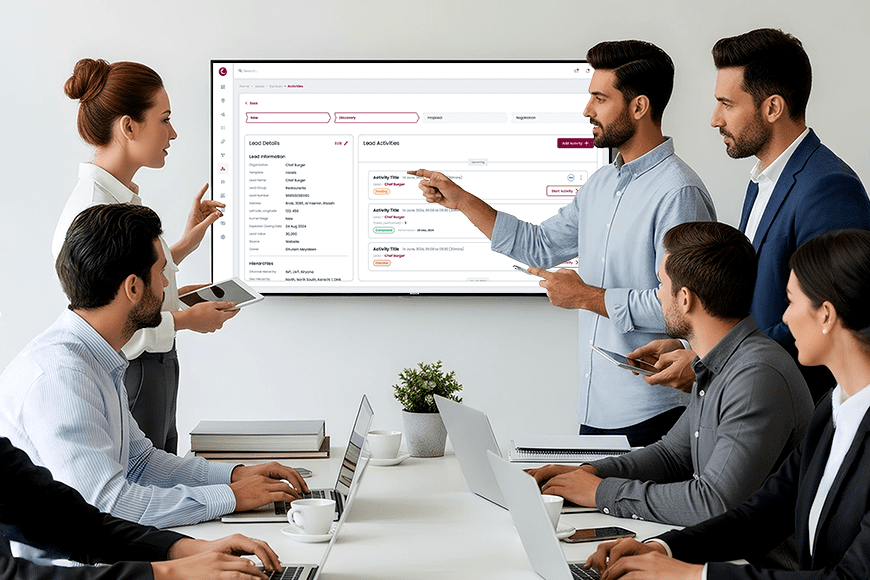

The Power of Order to Cash Management with Salesflo Core

Now that you know how critical the O2C cycle is, let’s talk about a solution built to handle it all.

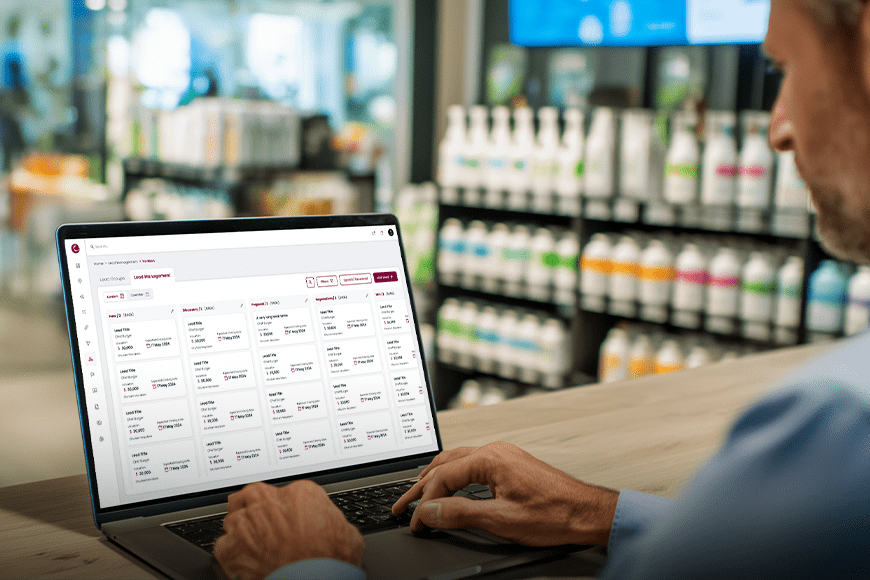

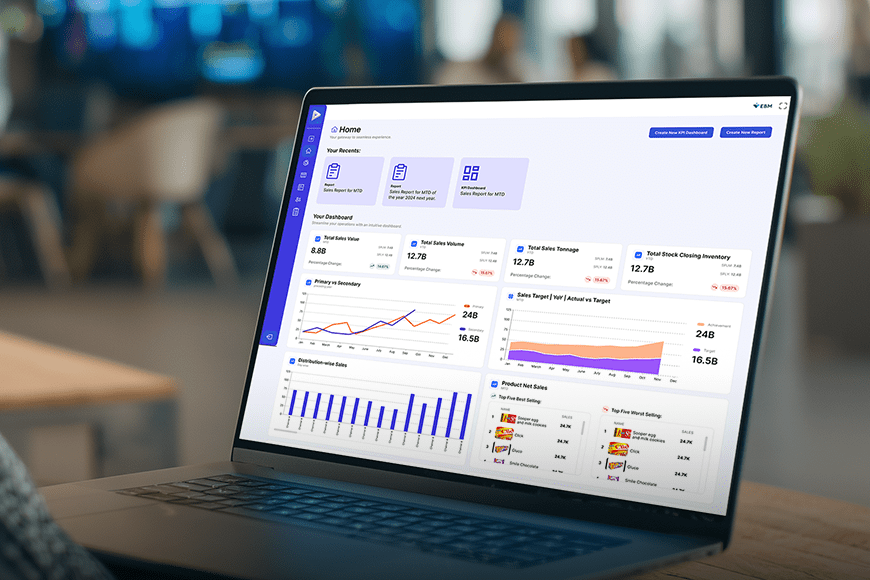

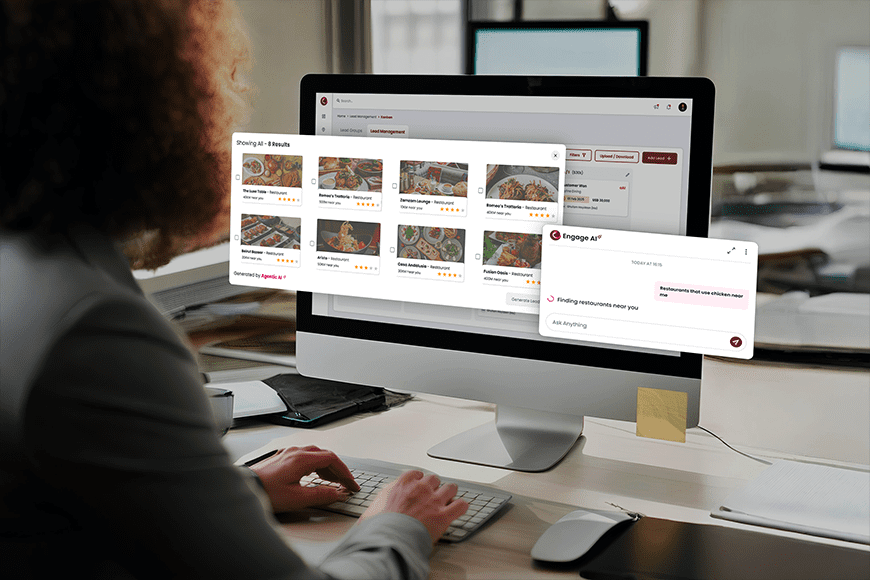

Salesflo Core is an award-winning sales and distribution management system designed to automate the entire Order to Cash process, especially for industries like FMCG, CPG, and pharma. Here’s how it helps:

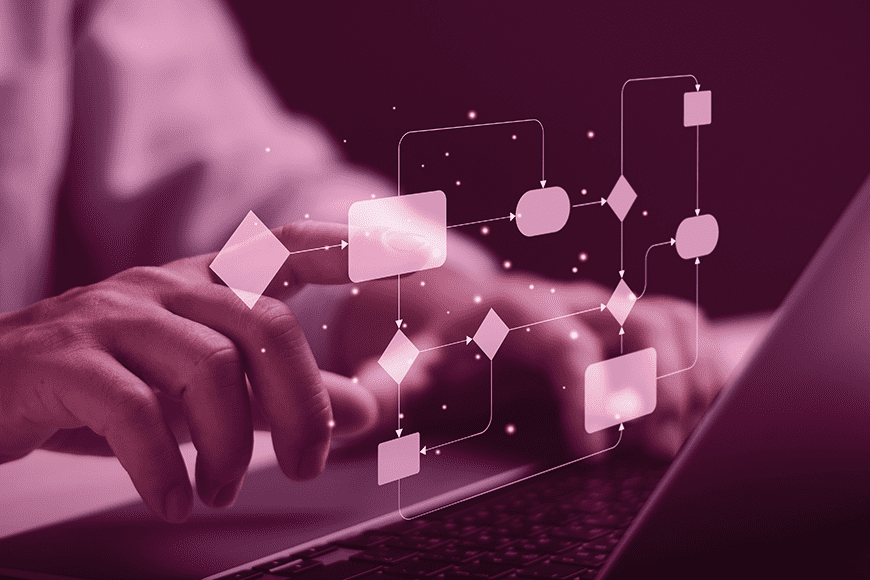

- Business Value Chain Automation: From order booking to delivery and invoicing, it streamlines every step and eliminates delays.

- Inventory Management: Get real-time visibility on stock movements, asset tracking, and store-level data.

- Integrated Financial Module: Automate invoice creation, manage accounts receivable/payable, and enforce credit limits, everything your finance team needs.

- Primary & Secondary Order Integration: Salesflo Core syncs distributor-level orders with principal ERP systems, offering end-to-end traceability.

- Field Force Empowerment: With its mobility app, field reps can place optimized orders, view store info, and run trade promotions – all on the go.

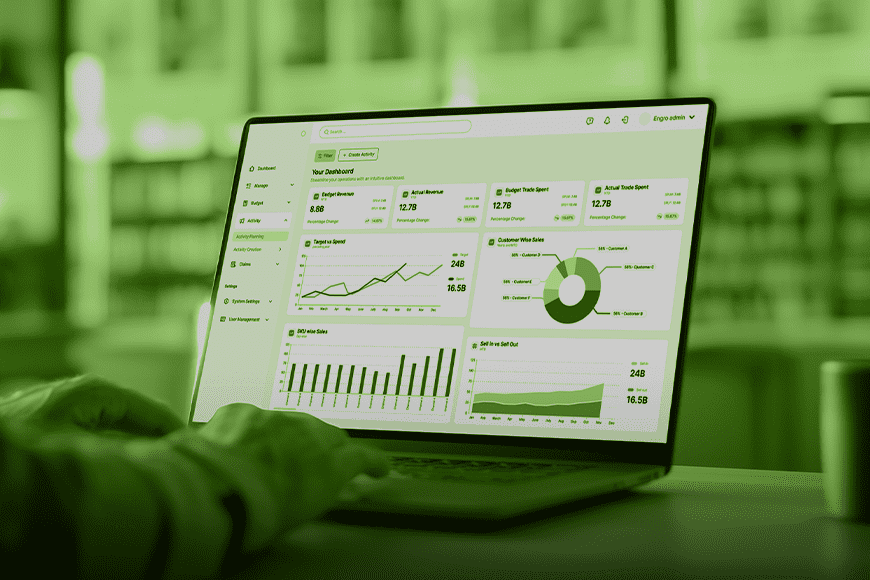

- Live Analytics & Reporting: Use powerful dashboards and data tools for Order to Cash analytics, so you can make faster, better decisions.

Whether you’re scaling operations or just want to get paid faster, Salesflo Core makes Order to Cash management simpler, smarter, and more strategic.

Final Thoughts

The Order to Cash process is more than a back-end workflow, it’s a frontline business strategy. When done right, it drives customer satisfaction, accelerates revenue, and unlocks operational excellence.If you’re serious about scaling efficiently and making your processes future-ready, start by optimizing your Order to Cash business process today.